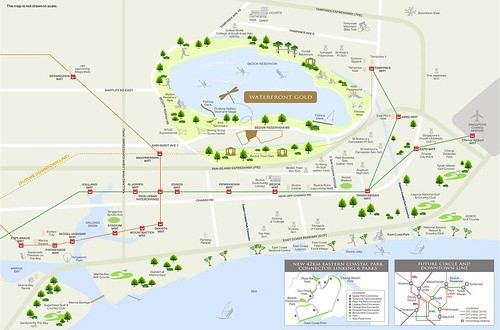

District: 16

Location: Bedok Reservoir Road

Developers: Far East Organization/ Frasers Centrepoint

Tenure: 99-year Leasehold (from 26th Nov 2009)

It has taken the wife and me quite awhile to get around to WATERFRONT GOLD, but we finally did so two Sundays ago. However, this review took a lot more time to produce due to business and leisure travels that we had to do over the past week.

WATERFRONT GOLD is third in the series of “Waterfront” condo co-developed by Far East and Frasers Centrepoint, after Waterfront Waves and Waterfront Key.

WATERFRONT GOLD is situated along Bedok Reservoir Road, across from Bedok Reservoir. This 99-year leasehold project resides on a plot of about 156,000sqft, and consists of 361 units in total housed in 5 main blocks of 15-storey each. It is expected to TOP in 2014.

The sales gallery/showflat is located exactly in the same spot where the former Waterfront Wave/Keys showflats were at. The actual site of WATERFROT GOLD is actually next door to the showflat – the wife and I understand that the showflat site is actually slated for another (i.e. Fourth) condo project, which will be solely developed by Far East this time.

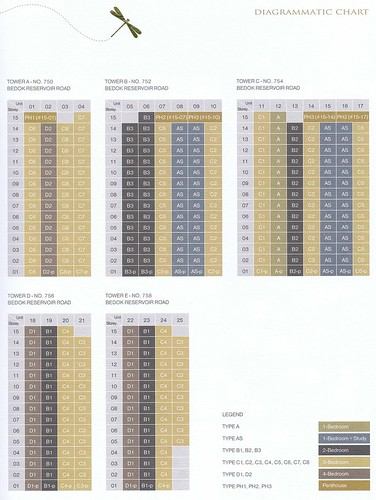

WATERFRONT GOLD first previewed at the end of June and the project was launched in mid-July. About 40% of the units comprise of 1- and 2-bedders:

• 1-Bedroom (15 units): 581sqft

• 1+Study (56 units): 667sqft

• 2-Bedrom (73 units): 872 – 893sqft

• 3-Bedroom (168 units): 1012 – 1356sqft

• 4-Bedroom (44 units ): 1378 – 1464sqft

• 4 & 5-Bedroom Penthouses (5 units): 1927 – 3057sqft

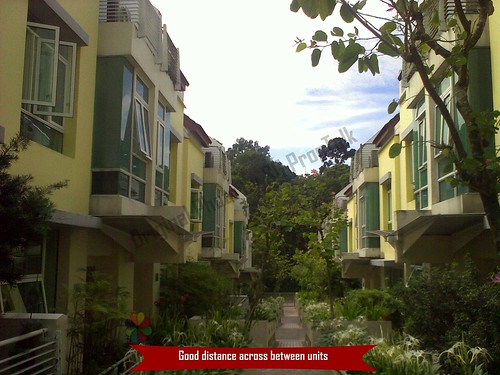

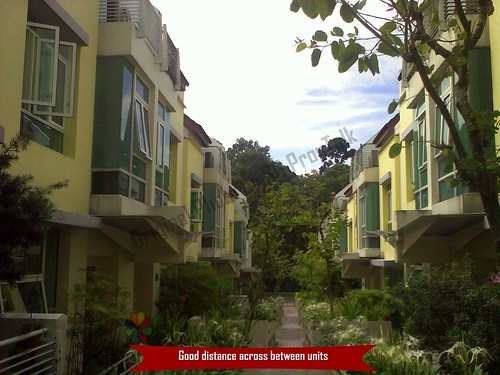

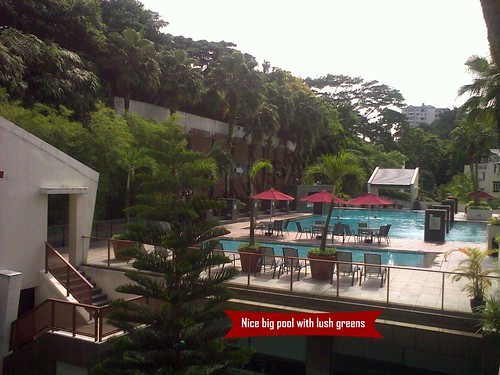

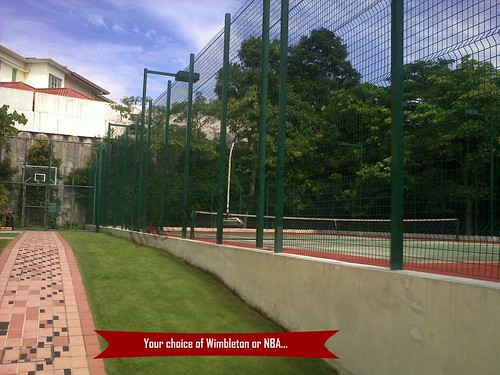

WATERFRONT GOLD is a full facility condo project, so one can expect to find your usual dose of different “themed” swimming pools, gym, clubhouse, BBQ pits and water features. It also comes with 2 tennis courts, which is quite generous for a project with just 361 units.

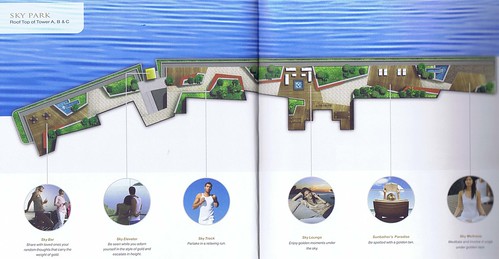

However, the main feature of WATERFRONT GOLD must be the 95-metre high Sky Park that traverses across the 3 blocks that face the Bedok Reservoir. This is accessible via a Bubble Sky Elevator and provides a breath-taking view of the reservoir - which at 88 hectares, is 40% larger than Marina Bay - and its surrounding.

The Sky Park also houses a host of communal facilities such as

• Sky Bar

• Sky Track

• Sky Lounge

• Sunbather’s Paradise

• Sky Wellness Deck

Parking wise, a total of 366 basement parking lots (inclusive of handicapped lots) are available for residents with cars. So it is the typical “1 lot per unit” scenerio although the marketing agent will want to tell you that residents of the smaller 1-bedder units will normally not own a vehicle. But the wife and I do not quite subscribe to that notion.

The only showflat on display is a 1216sqft, 3-Bedroom unit (Type C3).

As you enter the unit you see the kitchen. This is a rectangular strip of an area, with ceramic floors and comes furnished with “Electrolux” hob/hood/oven/fridge and “Grohe” kitchen faucets.

The developer has also thrown in some “extras” such as hanging dish-rack made of stainless steel and a semi glass-partitioned wall separating the kitchen and the dining area.

Those expecting a yard area will be disappointed, as this small space extension from the kitchen will mostly be taken up by the washing machine. If you decide on a separate dryer, this will have to be stacked on top of the washer. In the “yard”, you also find a small utility/maid’s room that will require some creativity to fit a bed inside, as well as a small bathroom.

The rectangular-shaped living/dining area is surprisingly quite huge for a unit of its size – you can comfortably fit an L-shape sofa and 6-seater dining table set here. It comes with 2.85m ceiling and 60cm x 60cm marble floors. You also get a small rectangular balcony that extends out from the living area, which probably has sufficient space for a small coffee table and 2 chairs.

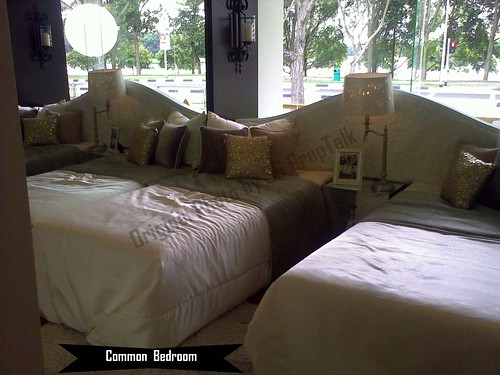

The 2 common rooms, which come with timber-strip floors, are regular shaped and average in size – the room can certainly make do without bay windows, which eat into the interior space. The wardrobe provided is rather small (as can be expected) and the quality of furnishing is nothing much to shout about.

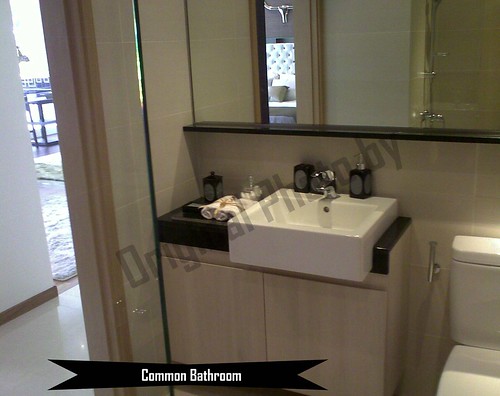

The common bathroom is quite decent size – you definitely would not feel claustrophobic in here. It comes with marble floors and ceramic walls, and is furnished with “Grohe/Duravit” bathroom and toilet fittings. You also get a standing shower stall with the normal wall-mounted shower.

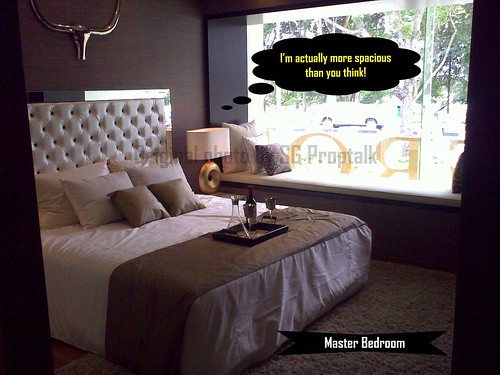

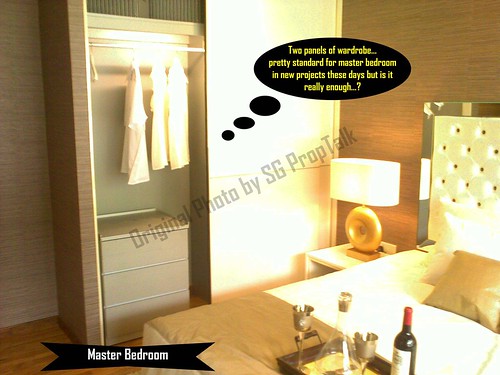

The master bedroom is very good size – you get easily fit a “King” bed and still have quite a bit of room. You also get a 2-panel wardrobe - hardly sufficient cupboard space for most couples but it is the common standard for master bedrooms these days.

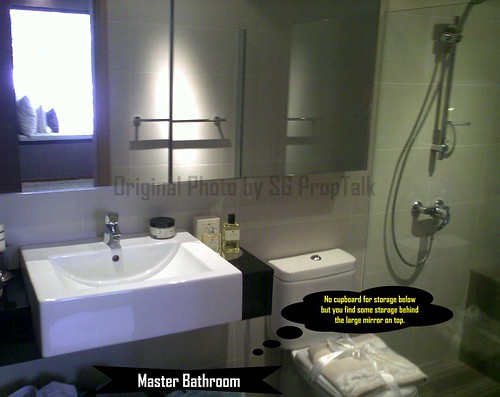

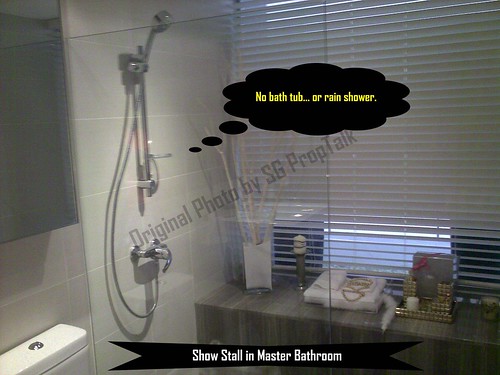

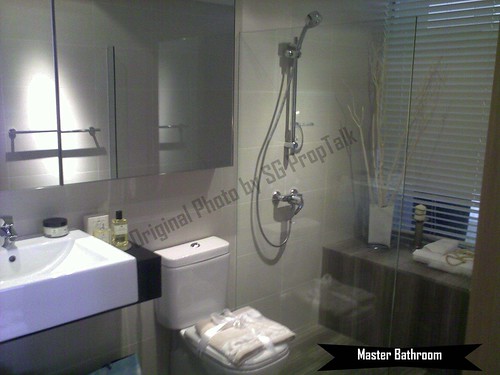

The master bathroom is actually huge, and comes with similar furnishing as the common bathroom. However, it does not have a storage cabinet beneath the wash basin as per the common bathroom, which is a pity. It also does not come with a bath-tub nor “rain shower” in the shower stall.

Pricing-wise, here are sample of what you can expect to pay for 3-bedder units in WATERFRONT GOLD that were still available during our visit:

• Tower E (#06-24) – This is a 1227sqft unit that faces the swimming pool: $1.11 million or $905psf

• Tower C (#06-14) – This is a 1055sqft reservoir-facing unit that is just above the tree-line. However, it does not have a yard or utility room/toilet: $1.108 million or $1050psf

The wife and I were told that all the 2-bedroom units that were launched in WATERFRONT GOLD so far have all been sold. Only 2 of the 4-bedoom units (Tower E, #14 & #15, 1378sqft) launched are still available.

Prices have already increased by about 2% since the preview, and the developers have also announced that there will be a further price increase when the project is re-launched last week (you may have seen the full page advertisement in The Sunday Times last weekend). This is largely due to confirmation by Land Transport Authority (LTA) on 20th August of the actual MRT stations along the stretch of Downtown Line (Stage 3) to be completed by 2017. WATERFRONT GOLD is situated within walking distance from Bedok Reservoir MRT Station.

We were also told that the proposed new development by Far East, which will be built on the site where the showflat of WATERFRONT GOLD is sitting on currently, is expected to be launched at much higher prices. And the two projects are just adjacent to each other with similar facing/views.

Much of what we like and dislike about WATERFRONT GOLD is pretty similar to Waterfront Key that we have reviewed back in February.

What we like:

• WATERFRONT GOLD is unblocked at the front and also mostly at the back. This means you will get a "view" irrespective of your unit's facing. Apartments facing the main Bedok Reservoir Road will get the reservoir view, while units at the back with have a park view. Inward facing units will overlook the pool areas and greeneries within the condo.

• Although WATERFRONT GOLD is not located near any big malls, ample amenities can be found within the HDB estates that is about 5 - 10 minutes walk away. These include a big Sheng Siong supermart, many neighborhood shops and food outlets along Bedok Reservoir Road.

• The upcoming Bedok Reservoir MRT Station along the Downtown Line Stage 3 is about a 10-minutes walk away. However, residents will have to wait for another 3 years or so after the TOP of WATERFRONT GOLD for thier nearest MRT station to be ready. Meantime, they will have to take a feeder bus to connect to Bedok or Tanah Merah MRT stations.

• WATERFRONT GOLD is located fairly close to Changi Business Park, the Japanese School as well as the upcoming United World College of SE Asia campus (2010) and Fourth University (2011). So there may be some good demand for rentals.

• There are several primary schools that are within 1-km of WATERFRONT GOLD – Damai Primary, Yu Neng Primary and the very popular Red Swastika Primary School. We were told that 2 other primary schools – Bedok West and Fengshan Primary may also be within 1-km.

What we dislike:

• The quality of furnishing and fitting are better than what we last saw at Waterfront Key (if our memory served us right), but it is still nothing much to shout about. The wife and I certainly expected better especially since Far East, being one of the co-developer, are certainly capable of better quality than what was showcased in the showflat of WATERFRONT GOLD.

• Given that all three “Waterfront”-series projects are lined up next to each other, we have the same concern about noise pollution from the traffic along Bedok Reservoir Road, which we understand is quite busy especially during rush hours. This is especially with units facing the main road (reservoir).

• The three “Waterfront”-series projects will add a total of 1193 new apartment units along Bedok Reservoir Road. This is in addition to the existing condo developments (Aquarius by the Park, The Baywater) and HDB estates that share the same stretch of road. And we can expect another 300 – 400 units from the upcoming new project by Far East next door to WATERFRONT GOLD. So be prepared for some heavy duty traffic jams on a daily basis, and possibly fierce competition in the apartment rental front when all these new apartment units get their TOPs.

In summary, the wife and I maintained that WATERFRONT GOLD, like its previous two “predecessors”, will probably appeal to the die-hard “waterfront living” buyers that do not want to pay the Marina Bay Residences or even Silversea prices. However, WATERFRONT GOLD is second rate at best (in our humble opinion, of course) when you compare it with other “waterfront” projects, if the quality we have seen is what we will get.

But given the currently selling prices of WATERFRONT GOLD, buyers of the previous two “Waterfront” projects must be delighted with their purchases – The URA caveat for May 2010 has indicated that the median price for Waterfront Waves was at $812psf, while that of Waterfront Key was $820psf. The final unit transacted at Waterfront Waves (in May 2010) was at $924psf, while the median price for Waterfront Key in July 2010 was $958psf. For WATERFRONT GOLD, the median price in July 2010 was $984psf.

.