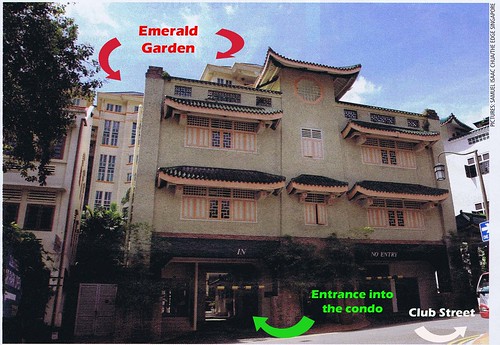

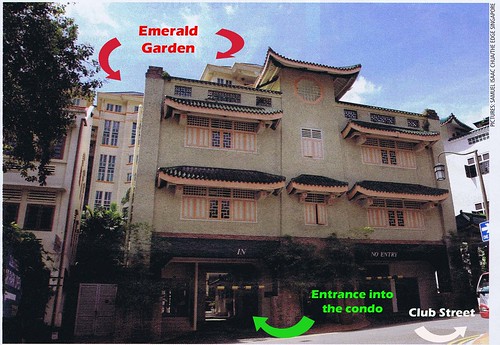

Emerald Garden is probably one of the most overlooked residential properties in the CBD. Located amid conservation shophouses on Club Street near Chinatown, the 265-unit residential project completed in 1998 was probably the first downtown private apartment development. It is within walking distance of both Raffles Place and Tanjong Pagar, and also the Tanjong Pagar, Chinatown and Raffles Place MRT stations.

The development could increasingly be on the radar screens of potential investors, with the upcoming Telok Ayer MRT station, also within walking distance, expected to be ready next year, says Darren Teo, a senior team director with ERA.

Teo reckons

Emerald Garden has been eclipsed by the newer 99-year leasehold high-rise condominiums in Tanjong Pagar, for instance

Icon on Gopeng Street,

Lumiere at Mistri Road and

76 Shenton Way, and the shiny new towers at

Marina Bay, also of the 99-year leasehold variety, such as

One Shenton,

The Sail @Marina Bay and

Marina Bay Residences. As such, apartments at

Emerald Garden have not been as actively traded as those in Tanjong Pagar and Marina Bay.

What’s more,

Emerald Garden, located in a conservation shophouse neighbourhood, has a 999-year leasehold status and is made up of six low-rise blocks, unlike the high rises found in Tanjong Pagar and Marina Bay. “Many of the owners are perhaps aware that it’s the only property with 999-year leasehold status, which is equivalent to a freehold status, and are therefore holding on to their units,” adds Teo.

Based on the caveats lodged with URA, from March 8 to 15, two units at

Emerald Garden changed hands at prices of $1,582 and $1,568psf. A 980sqft, two-bedroom unit on the 11th floor went for $1.55 million ($1,582psf), giving the seller a hefty 50.2% gain, as he had purchased the unit for $1.03 million ($1,053psf) from the developer a month after the project was launched, in April 1996.

The other transaction involved an 829sqft studio apartment on the second floor that went for $1.3 million ($1,568psf). This represents a 57.6% gain for the owner, who had also purchased the unit in 1996 for a mere $825,000 ($995psf).

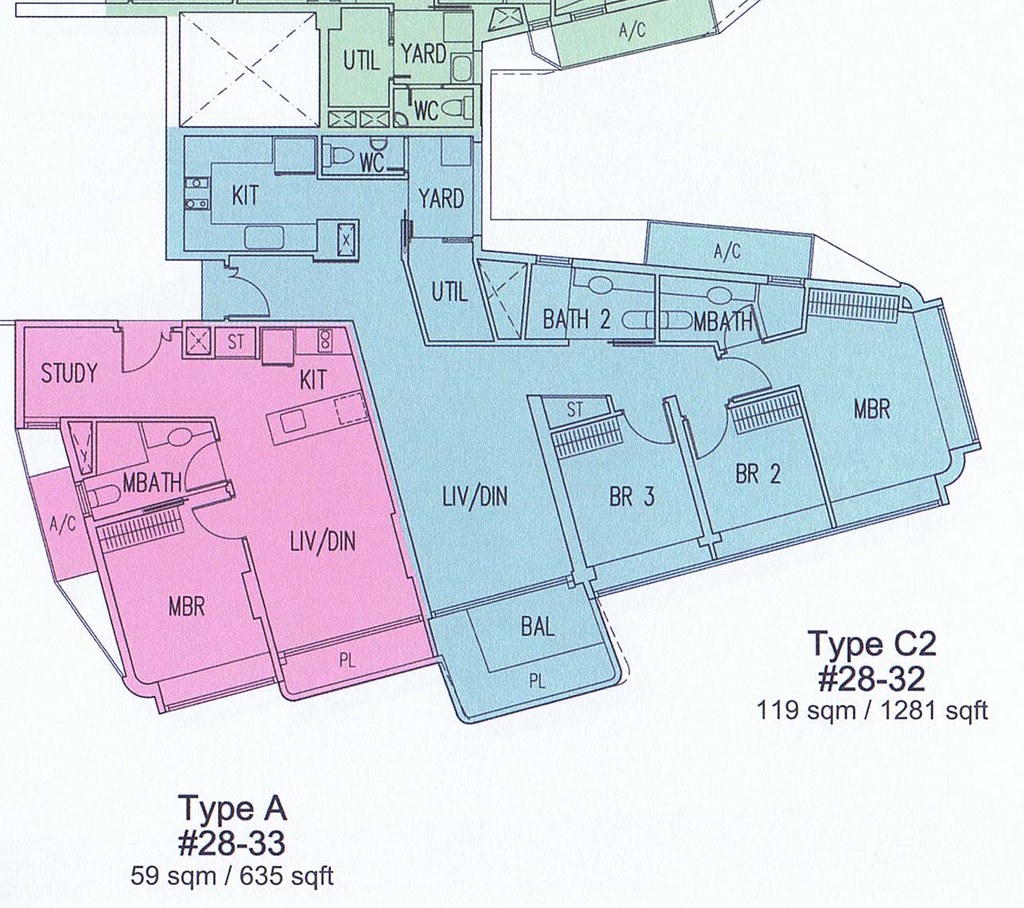

In addition to their 999-year leasehold status, the units at

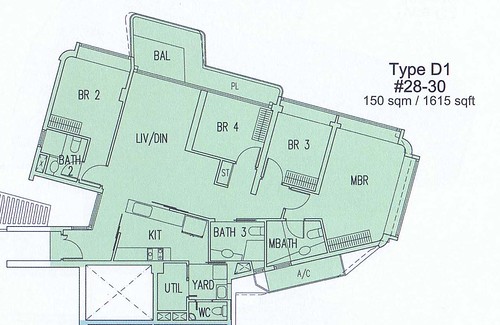

Emerald Green are also larger than those in newer developments, with studio apartments sized at 721 to 829sqft; two-bedroom apartments, 926 to 1,119sqft; three-bedroom apartments,1227 to 1,346sqft; and four-bedroom units, 1,507 to 1,991sqft.

Emerald Garden’s monthly rental rate is around $4psf, while the latest asking prices are in the $1,600 to $1,700psf range. This compares with asking prices of above $1,800psf at the 646-unit

Icon.

Even at the peak of the market, the highest price achieved at

Emerald Garden was $1,731psf, when a 1,259sqft apartment changed hands for $2.18 million.

* Above is extracted from a report in this week’s TheEdge Singapore.

With the lower psf price (for the moment, at least) compared to newer projects around the area and the bigger-sized units,

Emerald Garden does sound like a pretty good buy for those who enjoy living within the CBD. This is especially with Club Street enjoying a revival of sorts recently – you should check out the various new F&B joints along that stretch of road leading towards Ann Siang Hill. Most of these are crowded, even on weekday evenings!

.