Geylang is providing another housing option for those who want to buy condominium units at relatively affordable entry price levels, but which offer steady rental income. This is according to a report in this week’s TheEdge Singapore.

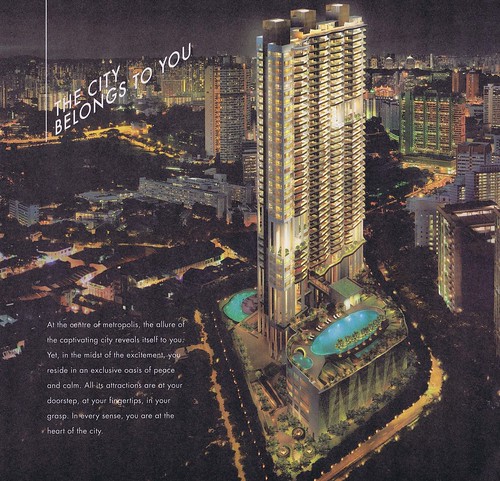

One such example is

Atrium Residences, a 142-unit freehold apartment block at Lorong 28 Geylang, which saw four transactions at prices ranging from $715 to $743psf in the Sep 28 to Oct 5 period.

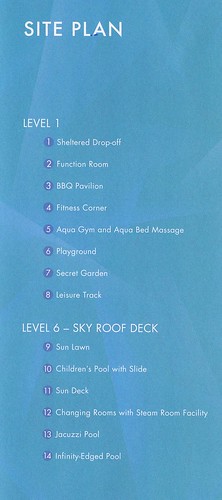

Developed by niche developer Novelty Properties Pte Ltd, the two-year-old

Atrium Residences is a freehold development where typical two- and three-bedroom units are from 807 to 1,302sqft, while penthouses are from 1,604 to 2,203sqft.

At around $700psf, units at

Atrium Residences are probably “some of the most reasonably priced freehold apartments you can find in Singapore’, says Marcus Fan, associate team director at PropNex, who specialises in properties at Geylang.

When the project was first launched in March 2006, prices at Atrium Residences were $300 to $500psf.

One of the four latest transactions, based on caveats lodged with URA, was for a 1,259sqft, three-bedroom, sixth floor unit that was sold for $900,000 ($715psf). For the seller who bought the unit from the developer for $712,888 ($566psf) in December 2008, this represented a 26% price appreciation in less than 2 years. On the same block, a 1,023sqft, three-bedroom unit on the third floor was sold for $760,000 or $743psf – the highest psf price achieved at Atrium Residences.

In another block, a 1,227sqft, three-bedroom unit on the sixth floor was sold for $880,000 ($717psf), representing a 25.8% gain for the seller who purchased the unit from the developer for $699,888 ($570psf) in March 2007. Meanwhile, a 1,216sqft, three-bedroom unit was sold for $880,000 ($723sqft) on Sep 29.

Several streets away on Lorong 40 Geylang are two much-larger freehold condominium projects – the 398-unit

The Waterina developed by CapitaLand and the 338-unit

The Sunny Spring by Sing-Indo Development Pte Ltd.

Even though they are older, both developments command higher psf prices than Atrium Residences owing to their location further away from the centre of the red-light district of Geylang, notes a property agent. The latest transaction at

The Waterina was for a 667sqft unit that changed hands for $725,000 ($1,086psf), according to a caveat lodged with URA on Sep 16. Asking prices for units in the project are now said to be around $1,000psf.

Meanwhile at

Sunny Spring, a 1,109sqft, three-bedroom unit on the third level changed hands at $830,000, or $749psf, according to a caveat lodged with URA on Sep 29. Asking prices of units in the project are said to be in the range of $700 - $800psf.

According to Fan, monthly rental rates for two-bedroom units at

Atrium Residences are around $2,800 to $3,200, while three-bedroom units could easily fetch between $3,500 and $3,800. In fact, Fan reckons at least 65% of the apartments at

Atrium Residences are tenanted, mostly to European, Japanese and Chinese expatriates.

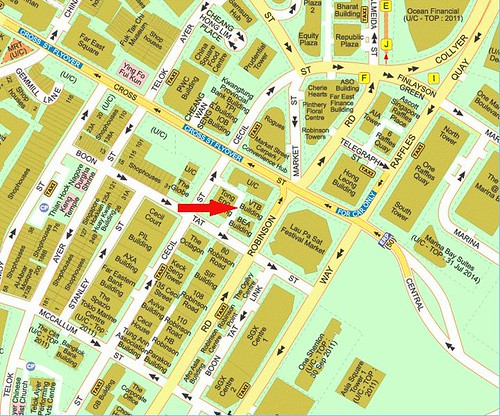

The location is convenient for these expatriates as

Atrium Residences is a 10-minute drive from the CBD, and there are two MRT stations – Dakota and Aljunied – just 10 to 15 minutes walk away.

Apartments at

Atrium Residences are also popular with young Singaporean couples as they are reasonably priced. For them, the proximity to the CBD outweighs the red-light district location, explains Fan.

The Geylang area tends to attract a niche group of homebuyers and investors who are cash rich as getting a home loan can sometimes be a challenge, says Fan.

Say all you want, but the wife and I will definitely NOT buy into a development in Geylang (at least in the foreseeable future), as the area is still far from being “family conducive”. Even when it comes to rental, it will probably appeal only to a very selected group of tenants.

.