Monday, January 31, 2011

Enbloc news: Robin Star

The BT today reported that Sing Holdings has acquired Robin Star for $47 million.

The 10-unit boutique development at 10 – 12 Robin Road will be combined with previously acquired Robin Court and 1 Robin Drive to make a combined site of 6,027.4sq m (= 64,878sqft).

The total purchase price of $124 million for the freehold sites translates to $1,297psf ppr, inclusive of estimated development costs of $5.28 million, Sing Holdings said.

Sing Holdings acquired Robin Court and 1 Robin Drive last September for $77.33 million.

The three sites were first collectively put up for sale in November 2007 by Credo Real Estate, sole owner of 1 Robin Drive and the agent representing the majority owners of Robin Court and Robin Star.

Credo slashed the asking price 40% the following year, putting Robin Court and 1 Robin Drive for $964-$996psf ppr, down from the initial asking price of $1,500-$1,600psf ppr.

Robin Court comprises 15 apartments, Robin Star 10 apartments, and No 1 Robin Drive is a detached house with a pre-school operating on its site.

Looks like the smaller sites are still having a field-day as far as collective sales are concerned...

.

Sunday, January 30, 2011

So is interest rate going up soon?

This is the strongest hint yet, if the report in the Sunday Times is anything to go by.

The Minister for National Development, Mah Bow Tan, has advised Housing Board flat owners looking to upgrade to a private property to wait a little longer before signing on the dotted line.

Serious home buyers should be patient, said Mr Mah, as he expects interest rates and the supply of private properties to rise soon, and both these factors should help to curb the steady trend of rising prices.

“When that happens, you will be thankful that you didn’t buy right now!” he said.

The property market hit new highs last year, fuelled by strong demand from cash-rich buyers, low interest rates and strong economic growth.

Private home prices moved up 17.6% last year after rising just 1.6% the year before. Non-landed property, which includes condominium units popular with Housing Board upgraders, rose 14%.

Mr Mah said the Government is trying to dampen a “flock” mentality that seems to have developed among property investors lured by the promise of making a quick profit.

He added that the recent market cooling measures – which include hefty sellers’ stamp duties and lowered loan limits for second mortgages – should be seen in this context.

For those who cannot wait and need to upgrade their homes right now, Mr Mah said he believed the new measures should not deter them as long as they have sufficient cash flow.

The minister also said that the Government is studying the effects of the latest round of measures closely, and warned that it could act again in 3 to 4 months’ time.

If Singapore Pools will to offer odds on interest rate going up over the next 3 to 4 months, the wife and I will definitely put some money on it…

.

Friday, January 28, 2011

Not 1 but 2 enbloc sales... but at lower than indicated prices.

As reported in the ST today, two collective sales have been completed.

However, both were at prices lower than earlier indicated, perhaps showing that recent cooling measures have tempered demand a little.

Marine Point

Marine Point in Marine Parade Road has been acquired by CapitaLand at $101 million. The owners wanted $110 million when the tender was launched in October.

If an estimated development charge of $12.8 million is included, the price works out to $1,056psf ppr, CapitaLand said.

Bartley Terrace

Bartley Terrace, near Bartley MRT station, was sold for $40 million. The tender was launched last year with an asking price of $48 million.

Meadows Investment, a firm owned by Mr Neo Tiam Boon, executive director of local property and construction firm Tiong Aik Group, bought the site in a private treaty, said marketing agent Urban Front yesterday.

The price works out to about $760psf ppr, inclusive of about $3 million in development charges and a 10% balcony allocation.

The District 19 freehold site has a land area of about 40,482sqft with a plot ratio of 1.4.

The owners of the 32 units stand to reap $1.14 million to $1.8 million each, Urban Front said.

.

DTZ's property prices outlook: Not more than 5% decline for 2011

As reported in today's TODAY papers:

The wife and I did say that we expect a price drop of slightly more than 10% this year. But who are we to dispute the experts...?

.

Thursday, January 27, 2011

Enbloc News 2: Marine Point sold for $100 million!

It was reported in the 9.30pm news tonight that Marine Point has been sold for $100 million in a collective sale.

Buyer CapitaLand is redeveloping the property into a condominium with 150 units, comprising one-bedroom plus study and two-bedroom apartments.

Marine Point sits on a 51,185 sqft freehold site with a maximum gross floor area of 107,488 sqft. The Marine Point site is located along Marine Parade Road, opposite the bustling Marine Parade Town Centre and Parkway Parade shopping mall.

Inclusive of an estimated development charge of $12.8 million, the total acquisition cost works out to $1,056psf ppr.

First one to kick-start 2011, with more to go..?

.

Enbloc News 1: No bids for Tulip Garden & Hawaii Tower..?

Excerpts from a ST report today:

An unusual quiet has come over the closing of several mega collective sale tenders that were launched amid much fanfare with $500 million-plus reserve prices.

New launches for collective sales, however, have continued unabated.

The lack of news on the closed tenders has stirred talk among some residents that developers’ bids, if any, may have fallen short of reserve prices.

Recent reports, for example, have suggested that Tulip Garden – whose tender with a reserve price of $650 million was launched early last month and closed last Thursday – had received no bids.

If Tulip Garden gets sold for $650 million, it would be the third-largest collective sale by value here and the first freehold one above $500 million in three years.

Meanwhile, Hawaii Tower in Meyer Road, with a $700 million reserve price and whose tender closed yesterday, also got no bids.

Experts say the collective sale market is being tested again with the Jan 13 property cooling measures leaving the market in flux as many were caught by surprise.

The collective sale market had picked up last year with more than 30 sales totalling about $1.7 billion recorded as home prices surged. The strong rebound had been expected to continue this year.

Tenders launched before the latest property measures, and closing since, may have struggled to meet ambitious reserve prices, experts suggest, though they say it is too soon to draw conclusions.

Mr Alwyn Low, director of Deans Realtors, said even if bids with no special conditions came in above the reserve price for a collective sale, they would still take about a week to be finalised. There is also 10 weeks after the tender closes for private treaties to be ironed out.

Mr Karamjit Singh, managing director of marketing agent Credo Real Estate, said the tender for the Whitley Heights apartments has been pushed back to March 2, owing to requests from developers to look into the more complex nature of developing strata-landed homes.

The collective sale momentum, however, has carried on to this year. At least 10 collective sale tenders have been launched this year. These include Holland Tower, Newton View and Ying Mansions.

.

Wednesday, January 26, 2011

New Project: Waterfront Isle

The wife received an email about the impending launch of Waterfront Isle - a new project by Far East along Bedok Reservoir Road.

This is supposedly the last project under the "Waterfront" collection. However, unlike the earlier three "Waterfront" projects (i.e. Waterfront Waves, Waterfront Key & Waterfront Gold), Waterfront Isle is not a joint development with Frasers Centrepoint.

Waterfront Isle is situated right next-door to Waterfront Gold. Matter of fact, the showfalt of Waterfront Gold was built on the site of Waterfront Isle!

Looks like the stretch of Bedok Reservoir Road has just gotten busier...

.

Monday, January 24, 2011

New project launches to test latest cooling measures

According to a ST report today, the impact of the latest property cooling measures could soon be tested as developers and marketing agents muster interest for three new project launches.

The Cape

Far East Organization has been marketing The Cape, its 76-unit development at Amber Road, as “the pairing of cosmopolitan sensibilities with idyllic sensitivities”.

At the district 15 freehold property – right next to the firm’s Silversea project – a one-bedroom unit of 600sqft to 650sqft is going for about $1.2 million, based on indications from some property agents. This would work out to about $2,000psf.

A two-bedroom unit would set a buyer back about $1.7 million. The prices will probably be subject to change until the project goes on sale – the timing is expected to be around Chinese New Year.

Far East is offering some early-bird buyers a 5% cash rebate, which will be paid out only when the project is completed.

La Fleur

This is a “shoebox” development in Geylang, which is expected to hold a preview today. All the 58 units are one-bedders, with sizes ranging from 409sqft to 646sqft. Prices start at an estimated $490,000 – or roughly $1,200psf.

The District 14 project, which consists of two 8-storey blocks, is being developed by Teambuild Properties.

Okio Residences

Over at Balestier, Okio Residences by SDB Asia – a subsidiary of Malaysia-listed Selangor Dredging – will be previewed on Thursday.

Half of the 104 units in the 18-storey freehold project are shoebox apartment of less than 500sqft. It also has two-bedroom units, with sizes ranging from 570sqft to 667sqft, and four penthouses that go up to 1,098sqft.

Agents said a 420sqft apartment would cost an estimated $650,000.

Experts said projects with smaller units were still being launched because the purchase price for such units remained manageable for buyers.

.

Saturday, January 22, 2011

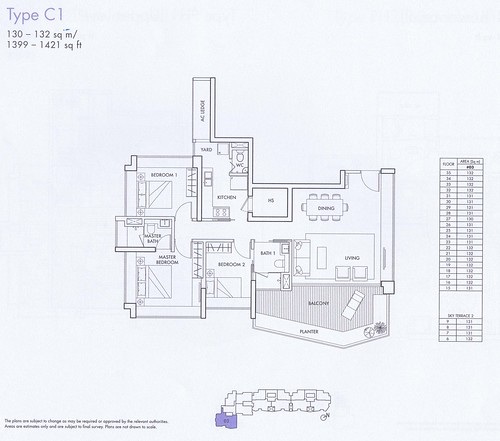

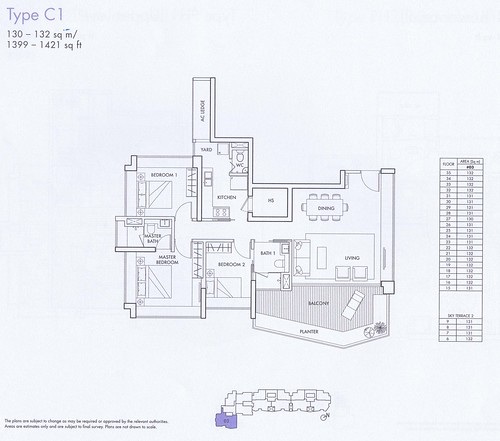

Spottiswoode Residences (Type C1 - 3-Bedroom)

.

The wife and I was at the sales gallery of Spottiswoode Residences today.

Below are photos we took of the 1421sqft, 3-bedroom (Type C1) showflat.

Before you get too excited, all the 3-bedders have been sold. But we reckon units are most certainly available in the resale market if you are still interested.

What we like:

• All bedrooms are tucked on one side of the unit, which ensue privacy.

• The common bathroom actually has two doors - one leading to the walkway into the kitchen/bedrooms and the other into the common bedroom next door. So you actually get two ensuite bedrooms.

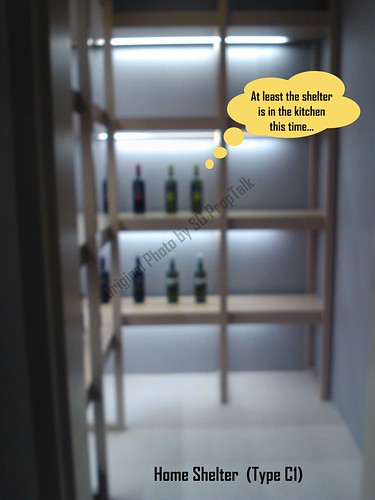

• The home-shelter is located in the kitchen, unlike the one- and two-bedders where the shelter is in the master bedroom. This is especially when we need to use this space for the maid’s room.

• Very good-sized yard area with window.

What we dislike:

• The wooden flooring in the kitchen is appealing to the eyes but is not very functional, especially if you are into heavy cooking.

• The common bedrooms are rather small, with the bay windows eating further into the already small space.

• The kitchen entrance is located too close to the bedrooms (especially common bedroom 1) for our comfort.

• Given that the unit is only 1421sqft, it really cannot afford a huge balcony. We reckon the balcony/planter box takes up about 150sqft (mabe even more) of the total unit area.

.

The wife and I was at the sales gallery of Spottiswoode Residences today.

Below are photos we took of the 1421sqft, 3-bedroom (Type C1) showflat.

Before you get too excited, all the 3-bedders have been sold. But we reckon units are most certainly available in the resale market if you are still interested.

What we like:

• All bedrooms are tucked on one side of the unit, which ensue privacy.

• The common bathroom actually has two doors - one leading to the walkway into the kitchen/bedrooms and the other into the common bedroom next door. So you actually get two ensuite bedrooms.

• The home-shelter is located in the kitchen, unlike the one- and two-bedders where the shelter is in the master bedroom. This is especially when we need to use this space for the maid’s room.

• Very good-sized yard area with window.

What we dislike:

• The wooden flooring in the kitchen is appealing to the eyes but is not very functional, especially if you are into heavy cooking.

• The common bedrooms are rather small, with the bay windows eating further into the already small space.

• The kitchen entrance is located too close to the bedrooms (especially common bedroom 1) for our comfort.

• Given that the unit is only 1421sqft, it really cannot afford a huge balcony. We reckon the balcony/planter box takes up about 150sqft (mabe even more) of the total unit area.

.

Still putting your money on interest rates not rising this year...?

Excerpts from a report in Weekend Today:

Banks should take into account potentially higher interest rates in their credit assessments and not assume that the current low cost of funds will last indefinitely, the head of Monetary Authority of Singapore (MAS) said on Friday, as he underlined the need to guard against the risks of asset bubbles.

“Many parts of Asia in particular are vulnerable to property bubbles, not only because of current liquidity conditions but also because many investors believe that, in a growing economy, the property market can only move up,” Mr Heng Swee Keat, the managing director of the MAS, said at the opening of French business school EDHEC’s Risk Institute Asia.

“Many have forgotten how the property markets in the region slumped during the 1997/98 Asian Financial Crisis,” he said.

He said policy makers must leave no doubt of their resolve to tackle the potential build-up of risks and must be willing to take progressively tougher measures, as MAS and other agencies in Singapore had done recently to cool the property market.

Urging banks to continue prudent lending practices, Mr Heng said the MAS will monitor bank activities closely.

If the wife and I are sitting on a big home loan, we should start to worry. The cooling measures implemented so far are "tame" by comparison: they (LTV ratio reduction, increase in seller stamp duties) only hit our pocket once per property transaction. But interest rate increases will hit us month after month until the loan is fully repaid...

.

Friday, January 21, 2011

Learned a new word today... Specu-vestors!

Talk about hybrids!

The report in today's ST should not come as a surprise to most. But the wife and I are a tad surprised that it took so long before such data are published - the data was obviously compiled for quite awhile, given that that the 2009 figures were available.

And it's not like the debate about investors/speculators (or specu-vestors!) distorting property prices had just started yesterday...

It is also the first time we see a property consultant (from a renowned property firm no less) acknowledging that the new measures "will likely lead to a steep fall in both volumes and prices"......

.

Oh c'mon, what happened to "shoebox apartments" in Auckland cannot possibly happen in Singapore... can it?!

One of our "Anonymous" readers has posted a weblink about the "shoebox apartments" situation in Auckland back in 2005. (* Thank you, Anonymous 20/1/11 10:42pm *)

http://www.nzherald.co.nz/property/news/article.cfm?c_id=8&objectid=10352969

The wife has found a more recent article from Singapore on the rental prospects for such "shoebox" units. Recall that this article was written when the property market was still red hot, way before the latest property cooling measures took effect and more importantly, when the median price of "shoebox" units was just $1,300+psf!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++

Oct 3, 2010

Leasing out a shoebox flat

While Mickey Mouse flats may be relatively affordable, buyers should be aware that rents depend on location and proximity to amenities

By Joyce Teo

joyceteo@sph.com.sg

Buying a shoebox apartment for lease sounds like a very attractive proposition because such units are relatively more affordable. But investors should know what to expect because not everyone will want to rent such small units, experts said.

A record number of these small-format homes - also known as Mickey Mouse flats - have been sold in the first three quarters of the year, and at higher and higher prices.

The sale of 906 apartments of 500 sq ft and below in that period is 84 per cent higher than that in the same period last year, said CBRE Research, citing URA Realis. This has also exceeded the full-year sale of 722 units last year, it said.

Median prices of such homes have risen to $1,314 per sq ft (psf) so far this year, from $1,190 psf last year, and asking rents on a psf basis are comparable to those for prime developments in town.

'At first glance, investing in shoebox apartments might appear to be an attractive proposition due to the relative quantum affordability and rental yields,' said CBRE Research executive director Li Hiaw Ho.

However, the rents will depend on many factors, such as location, proximity to amenities, and demand and supply conditions, he said.

Currently, some owners of one-bedroom and studio units in projects such as Kembangan Suites in Kembangan, Parc Imperial in Pasir Panjang and Soho 188 in Race Course Road are asking for rents of $2,000 to $3,600 a month.

In July, a 431 sq ft one-bedroom unit in Urban Lofts in Rangoon Road was leased out at $2,400 a month, while a similar-sized one-bedroom unit at Mountbatten Lodge in Mountbatten Road went for $2,300 a month.

Based on current valuations, indicative gross rental yields for shoebox units are estimated at 3 per cent to 5 per cent, said CBRE Research.

'These figures, however, do not take into account the utility and condo management fees, insurance, mortgage interest payments, property taxes and maintenance charges - all of which will make the net yield considerably lower,' said Mr Li.

ECG Property chief executive Eric Cheng said most people buy shoebox units to lease out but they should be aware that any rental projection given at the launch may not pan out.

For instance, when a project in the Thomson area was launched a few years ago, the rentals were projected at $3,500 to $4,500 a month, but the transacted rents now are more like $1,800 to $2,600 a month, he said.

Cushman & Wakefield's senior manager of Asia-Pac research, Mr Ong Kah Seng, said a large supply of shoebox apartments is scheduled for completion, and rents may come under pressure as leasing competition intensifies.

Also, while tiny apartments seem suitable for single expatriate tenants, not all will want to pay so much for a small unit unless it is in a prime area, or conveniently located near an MRT station, experts said.

Said Mr Ong: 'Owners of shoebox apartments... can at best rely on junior expatriates, besides local professionals.'

But since junior expatriates are cost-sensitive, they may be open to HDB flats which are conveniently located and offer a larger space for nearly the same rent as that for a shoebox apartment, he said.

Yet, CBRE Research found that more people are paying higher prices for a shoebox unit during new launches.

Buyers picked up 383 new shoebox units which cost $600,000 and above in the first nine months of this year, compared with 133 last year and 121 in 2008.

Experts said the question is whether these units can support even higher rentals when they are completed.

The introduction of cooling measures by the Government in late August has also affected the 'flippers'. Extending the imposition period of the sellers' stamp duty of about 3 per cent from one to three years makes it less lucrative for speculators to flip a unit, experts said.

Previously, investors could make significant capital gains from shoebox units with just a small investment sum and a short holding period.

Of the shoebox units launched last year, 66 units were sold in the first eight months of the year for capital gains of $6,400 to $232,000, said CBRE Research.

But for projects launched this year, only four units were sold and gains were in the $9,400 to $101,000 range, it said.

The 'already high buy-in prices' during a new launch might make it hard for an investor to sell it later at higher prices unless it is in a prime location, said Mr Li.

In the next few months, about 10 projects with mainly small-format units are expected to be launched. Apart from one in River Valley Road, the rest are in suburban areas such as Geylang and Eunos, said CBRE.

+++++++++++++++++++++++++++++++++++++++++++++++++++++

The wife and I concede that "not all shoeboxes are built equal", while location and proximity to amenities do make a difference. But as one can see from the Auckland example, sometimes even a good location can do little once the supply floodgate is wide open.

Yes, we do come across as the ultimate doomsayers on the subject of "shoebox apartments". And we are definitely not being sarcastic when we say we really hope to be proven wrong on this one...

.

Wednesday, January 19, 2011

Spottiswoode 18: A reader's perspective

The wife and I have received an email from one of our readers who was at the launch of Spottiswoode 18 yesterday. And below are his thoughts about the project:

"Hi, I've enjoyed reading your blog and thought I'll send you some photos of the showroom and my perception at the launch yesterday.

At 630pm, only the 25 floor and above for the 1bdrm units were available. Prices are $2200psf for 25th floor after launch discount. A 2bdrm unit on the 15th floor is $1900/psf.

Seems that the developer's agents, associates and VIP clients had snapped up most of the low floor units already.

The 2 show units are the 2bdrm (650+ sq ft) and the 1bdrm (387sq ft). The units do not have bay windows and the balconies are significantly smaller than the huge ones at Spottiswoode Residences. In fact the 2 bedrooms at the S18 are almost the same size as the 900sq ft equivalent at SR.

Pls feel free to use these photos and the info above, but pls keep my name and email private and confidential."

We would very much like to give credit when credit is due, but we also respect the author's request for privacy. So thank you very much for the contribution - we are certain that this is most appreciated not just by us, but also those who are sick of just hearing from us. :-)

The wife and I certainly welcome more contributions from our readers about your showflat visits, so keep those coming!

.

Jumping onto the "buy a shoebox unit for rental income" bandwagon...

With some free time in our hands this morning and encouraged by the good response at Spottiswoode 18, the wife and I decided to run our sums on a "shoebox" unit for investment (rental) purpose.

Our assumptions are based on:

1. The smallest available unit in Spottiswoode 18, i.e. 387sqft

2. A purchase price of $735,000 (= $1,900psf)

3. A loan quantum of 60% (=$441,000)

4. A loan period of 25 years

5. An interest rate of 1.5% p.a. on monthly rest

Loan Repayment Table

Based on the loan repayment table that we have complied (above), the monthly loan repayment for the purchase comes to $1,764. So this is the minimum amount of rental that we will need to cover the loan (actually we will probably need about $2,000 if we do not wish to be out of pocket on the monthly maintenance/sinking fund).

And given the bargain-basement loan rates that the banks are offering at the moment (below 1.2%), the sums still make sense. For a 3% rental return, we are looking at a rental of just $1,837/month to cover ou rmortgage.

But what if interest rates climb back to the pre-2008 levels of 3.5% over the next 2 - 3years? The monthly loan repayment at 3.5% will jump to $2,209, which needs a minimum rental yeild of 3.61% to cover our mortgage cost.

And if by some freak of nature the mortgage rates skyrocket to 5.5% (don't laugh, it can happen), we are now looking at a monthly repayment of $2,708, which will require a rental yield of at least 4.43%

So the question becomes:

1. Will our 387sqft apartment in Spottiswoode 18 be able to fetch at least $2,000/month in rental (i.e. to cover our mortgage and maintenance/sinking fund)?

Given the excellent location of the project, it should not be too difficult to get $2,000 even if our unit is less than 400sqft and the fact that there will be hundreds of such "shoebox" units in the market by then, right??

2. Is it realistic for us to expect a 4 - 5% rental yield return (i.e. $2,450 - $3,062/month) on our "shoebox" unit, especially if interest rates start climbing?

Then again, interest rates are so low now and it probably won't go up much over the next few years... or will it??

We will leave you to form your own judgements...

.

Sales Update: Spottiswoode 18

The ST today reported that some property buyers shrugged off the latest cooling measures to take up flats at yesterday's preview of Spottiswoode 18, which will be built on the old Dragon Mansion site in Tanjong Pagar.

Around 68% or 170 units out of the 251 units up for grabs were sold, said developer Roxy-Pacific Holdings.

The units sold were mainly smaller flats. Average prices were $1,900psf and the price of a 387sqft, one-bedroom unit started from a relatively affordable $688,900.

More than half of the units at the project near Tanjong Pagar MRT station are “shoebox” apartments – less than 500sqft in size.

While the response was strong, its average psf prices were also marginally lower than what nearby Spottiswoode Residences had been fetching recently.

Some former Dragon Mansion owners said they were interested in the new property for sentimental reasons while many others said they were still keen to buy for investment, given the low interest rates.

And they kept on coming…

.

Tuesday, January 18, 2011

Spottiswoode 18: Soft launch starts today!

According to a BT report, Roxy-Pacific Holdings will roll out its new residential project, Spottiswoode 18 today.

Prices at the project on Spottiswoode Park Road will start from $688,900, the developer said yesterday.

The 251-unit Spottiswoode 18 has one- and two-bedroom units as well as duplexes and penthouses. Units range in size from 387sqft to 1,324sqft.

More than half of the units – 150 out of 251 – are 387sqft.

Spottiswoode 18 will be built on the site which now houses Dragon Mansion. Roxy-Pacific bought the 72-unit Dragon Mansion in a collective sale for $100.8 million, or $863psf ppr including the estimated development charge.

From the original 72 units that was Dragon Mansion to the 251 units that will be Spottiswoode 18, this translates to a 3.5 times increase in the number of apartments on the same site area. And assuming that the start price of $688,900 is for the smallest apartment at 387sqft, this equates to about $1,780psf.

But yes, the quantum amount is affordable…

Spottiswoode 18 (Project Info)

.

'Shoe boxes' here to stay... Really?!

The BT ran an article yesterday on “small-format apartments” developer Oxley Holdings. Below is an excerpt of the report:

The demand for “shoe-box” apartments is here to stay, says Ching Chiat Kwong, controlling shareholder and chief executive officer of Oxley Holdings.

“If you look at the way Singapore is developing – high economic growth, rising home-owning aspirations, more local and expatriate singles, young couples who prefer dogs rather than kids – you can see a very clear demand pattern emerging,” he noted. “There is a market for good-quality, affordable private homes in good locations.”

And it is a demand which Catalist-quoted Oxley hopes to capitalize on. The company specializes in building private apartments sized at around 350 – 400sqft, with a living room, one bedroom and fully fitted kitchenettes.

In just three months following its Oct 2010 listing, the company has sold out five of its “shoebox” apartment projects. Its Loft @Holland sold out within two hours of launch last week. This year it will launch at least nine more, and at least two commercial projects.

Mr Ching says the buyers of his apartments are not just singles and young couples, but also investors. “The rental yields from these properties tend to be good, so they make attractive investments as well,” he said.

Despite the property market curbs unveiled last week, Mr Ching does not appear to be overly concerned. “The key is affordability, and this becomes even more important under the new rules,” he said. “The projects we will launch this year are in prime locations, and more importantly, they are affordable. We will also launch several major commercial developments which are not impacted by the residential property curbs.”

Oxley’s business model is simple: Gear up to the maximum to acquire land, quickly launch units off the plans, maximize plot ratio, keep prices affordable, and keep project turnover short at around 7 – 9 months.

The company’s five projects launched last year raked in sales of some $260 million. Given its 40 to 50% margin, analysts reckon the profit from these could come up to over $100 million. This year it will bring to market almost $2.5 billion worth of projects.

These include nine apartment projects at prime urban and suburban locations like Holland Village (last week), Stevens Road, Devonshire, Telok Kurau, River Valey Road and Bradell Road.

After reading the BT article, the wife and I must certainly take our hats off to Mr Ching and Oxley Holdings for the achievements made over a short period of 2 years. And yes, “shoe boxes” looked to be here to stay. But the question is: for how long?

We wonder how many of those “singles, young couples and investors” that have bought into such shoebox units had based their decisions solely on the “affordability” argument without considering what living in an apartment of 350 – 400sqft is like. Yes, the showflats may look comfortable enough to live in, but that is before the furniture, clothes, shoes and whatever other earthly possessions that you may need space for in your home. And even with singles and young couples, such belongings do take up a fair bit of space!

And yes, there may be more young couples who prefer dogs rather than kids these days. But even dogs need their own space - you cannot possibly allow it to run around the lift lobby all the time or keep it in the stairwell.

But the wife and I certainly hoped that Mr Ching is right. This is especially for the sake of those who have bought and planned to live in such “small format” apartments, or investors hoping for high rental yields on their shoebox units …

.

Monday, January 17, 2011

Breaking news: December private home sales ease...

It was reported in the 9.30pm news that December 2010 private home sales fell 580 units compared to November 2010.

However, private home prices in the suburban region have set a new high.

A total of 1,332 new private homes (1,699 if including ECs) were sold in December, with a total of 4,850 new units launched during the month.

In the suburban region, Centro Residences in Ang Mo Kio achieved a median price of $1,400psf. This is in comparison to the $1,500psf median price for d'Leedon in Farrer Road.

More details to follow tomorrow...

.

d'Leedon: Second Release @Preview Price!

Please contact Fred if you are interested in d'Leedon.

And no, we are not related to Fred.

d'Leedon (2nd Release)

.

Weekend sales update: Business as usual...?

The ST today report that it was business as usual at property show-flats at the weekend, as crowds continued to flock to new launches despite the Government announcing stricter rules to cool the market last Thursday.

But not all the show-flat visitors were there to buy homes: many were checking out the market and waiting to see what impact the measures would have.

Still, developers managed to move units at projects ranging from high-end bungalows to suburban condominiums.

At Five Chancery at Chancery Lane, 2 out of 12 freehold strata bungalows have been sold since sales started on Saturday, at prices starting from $5.9 million a house.

Amid a steady stream of visitors, Far East Organization sold another 8 units of its recently launched project, The Tennery in Bukit Panjang, at the weekend.

This brings the total number of units sold so far to 313, with the average price at $1,200psf.

Over at Kovan, agents said they sold about 20 out of 64 units at the preview of iSuites@Palm off Glasgow Road.

Prices for a one-bedroom unit start at $557,000, or about $1,295psf.

Following the property measures, some marketing agents have stepped up their sales tactics. Far East Organization is now offering furniture vouchers to encourage sales, while iSuites @Palm dangled a 17% discount at its launch.

Despite the supposed “healthy turnout” last weekend, one can certainly see that new launches are no longer “flying off the shelves” as they have been prior to the latest cooling measures. The wife and I wonder if developers will start giving out car for each purchase soon…

.

Saturday, January 15, 2011

Is your estate trying for en bloc in 2011..?

This article in the Today paper may be interesting read especially for those who are party to a collective sale (in one manner or another) this year.

And in case you wonder: The wife and I reckon that neither Tulip Garden nor Pine Grove will have any joy with their en bloc sale this year, especially at their current asking prices...

.

Friday, January 14, 2011

Loft @Holland sold out within 2 hours of private preview

You may already have read from the ST today that Loft @Holland, a project by small-format homes specialist Oxley Holdings, saw all 41 apartment units taken up within 2 hours of a private preview yesterday.

As there were more buyers than homes on offer, balloting was conducted for all but two units. On average, there were about three buyers for each units.

Price ranged from $1,630psf to $2,166psf. Buyers were mainly Singaporean.

Located at 151 Holland Road, the five storey development comprises 37 one-bedroom units, ranging from 323sqft to 484sqft.

There are also four two-bedroom penthouses with private Jacuzzis, ranging from 980sqft to 1,141sqft.

Communal Facilities include a basement carpark, a swimming pool and a gym.

Loft @Holland’s successful sale underscored the developer’s belief in strong demand from buyers for small-format apartments.

Mr Ching Chiat Kwong, executive chairman and chief executive of Oxley Holdings had said earlier he was confident that these units, popularly known as shoebox apartments, would be well received as quantum prices will be affordable.

The group has launched five other projects so far: Suites @Katong, Parc Somme, Loft @Rangoon, Viva Vista and RV Point.

Shoebox flats tend to have low overall values – often under $1 million – but high prices on a psf basis.

Sales of these flats – they are under 500sqft – have been steadily increasing since they hit the market in 2006.

According to figures from property consultancy CB Richard Ellis, a total of 1,436 caveats were lodged for new shoebox units by mid-December last year, compared with 725 in 2009 and only 274 in 2008.

The wife and I cannot help but wonder if the response to Loft @Holland will be as fantastic if the private preview was held after yesterday’s announcement of new property cooling measures – we understand that the preview started yesterday morning while the Government announcement was made only after the stock market closed.

It will also be interesting to see if there will be a disproportionate number of buyers who ultimately choose to forfeit their 1% option money…

.

Thursday, January 13, 2011

Breaking News: More property cooling measures announced!

A fourth set of property cooling measures was announced by the Government today.

From tomorrow (14th January 2010):

• The holding period for imposing Seller's Stamp Duty (SSD) is raised to 4 years from the current 3 years.

• The SSD rates will be raised to 16 per cent, 12 per cent, 8 per cent and 4 per cent of consideration for residential properties which are bought on or after Friday, and are sold in the first, second, third and fourth year of purchase respectively.

• The loan-to-value limit is reduced from 70% to 60% for individuals with one or more outstanding housing loans at the time of the new housing purchase.

More details tomorrow...

.

Tuesday, January 11, 2011

Here's one on landed property...

Another of them interesting article from the Today papers.

Would you agree or disagree with the writer?

.

New residental projects: Loft @Holland & Vibes @Kovan

According to a report in the Today paper, Oxley Holdings is set to unveil two new residential developments: Loft @Holland and Vibes @Kovan.

Loft @Holland

This is a 42-unit apartment building located at 151Holland Road. It consists of 37 one-bedroom units, with sizes ranging from 323sqft to 484sqft, and four units of two-bedroom penthouses, ranging from 980sqft to 1,141sqft. (* Yes, 37 + 4 = 41 so what happen to the last unit? Unfortunately this is as per reported so we really don't know *)

The development has a basement carpark, swimming pool and a gym.

Its expected TOP date is December 2015, while the legal completion date is expected on December 2018.

Loft @Holland is located near the Holland Village MRT Station, Holland Village Shopping Centre, and Chip Bee Garden eateries.

Vibes @Kovan

This is a five-storey freehold development located at 93 Kovan Road near Serangoon MRT Station and Kovan MRT Station. The new NEX shopping mall is also close by.

Vibes @Kovan will have 36 units. They range from one-bedroom, one-bedroom plus study, and two-bedroom units with sizes from 377sqft to 570sqft.

There are also nine penthouse units, of two-bedroom and two-plus-one-bedroom configurations, ranging from 732sqft to 1,001sqft.

Amenities include a basement carpark, swimming pool and gym, as well as five shop units on the first floor, with sizes ranging from 269sqft and 710sqft.

The expected TOP date is 31st Dec 2015, while the expected date of legal completion is 31st Dec 2018.

.

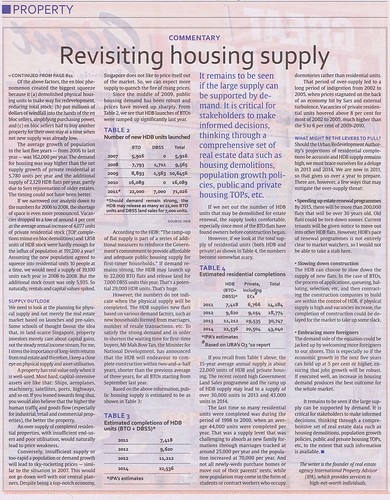

Friday, January 7, 2011

The best time to buy your dream home is...

The wife came across this rather informative article in the Today papers today.

Despite the fact that we get this newspaper for free everyday, I always had the impression that there is nothing in there that is not already reported by the ST or BT. Guess we learn something everyday...

So the best time to buy is during 2013 - 2014 then? I mean... how can our URA and HDB projections be wrong, right...?? ;-)

.

Thursday, January 6, 2011

The "shoebox" price euphoria - Representative or skewed?

Below is a rather interesting article published in the ST today.

The answer will most certainly depend on whether you ask a potential buyer or seller, but the wife and I have seen enough "real-life" examples of how a single transaction can skewed opinions/expectations about the price of units within a development.

If you have been following our blog, you will know what our stand on these "shoebox flats" is. The rental may be up 11% in the first nine-months of 2010 while the absolute value of such units may be easier on the pocket, but the rental market looks set to soften with the number of new flats TOP-ing next year. And once all these "mickey mouse" units come onto the market in the next 2 - 3 years, one has better pray that there be enough takers (middle-income singles, DINKs, rich parents who want to kick their child out of the house...etc etc) for such tiny units. One might argue that the "expats market" will still exist as Singapore continues to import foreign talents. However, will many of these foreigners be interested in renting/buying a flat that is less than 500sqft in size? THAT is the million-dollar question... okay, make that slightly less than a million (given that most of the shoebox flats are supposedly priced below the psychological $1 million mark).

It may already be too late when you realized that you cannot get sufficient rental to cover your monthly loan repayment after paying sky-high psf price for that shoebox unit, or worse... cannot rent, cannot sell.

Let's just hope that we are wrong, else there'll be an absolute blood-bath come 2012 -2013...

.

Tuesday, January 4, 2011

Overall price growth for private homes in Q4 2010, particularly luxury homes

As reported in the BT today, a surge of interest in high-end and luxury homes pushed prices in the segment, which has underperformed the rest of the market over the last two years, to a fresh all time high in Q4 2010.

But in the rest of the market, prices of private homes as well as HDB resale flats grew more slowly in the fourth quarter compared to the first three quarters of last year.

Flash estimates released by the Urban Redevelopment Authority (URA) yesterday show that overall private housing prices edged up 2.7% in Q4 to a fresh record high.

Private home prices in Singapore first surpassed the former all-time peak achieved in 1996 in Q2 2010, and then continued to inch upwards in Q3 and Q4. For the whole of 2010, prices climbed 17.6%.

But the gain in fourth-quarter prices was the smallest in six quarters, URA’s data shows.

The high-end market was a notable exception. Non-landed home prices in the Core Central Region (CCR) micro-market, which includes the prime districts Marina Bay and Sentosa Cove, rose 2.3% in Q4, faster than the 1.6% growth seen in Q3.

This pushed luxury home prices to a new all-time high, outstripping the previous peak in Q1 2008.

By contrast, the price index for Rest of Central Region (RCR) rose by 1.7% in Q4, down from 2.3% in Q3. And in the Outside Central Region or OCR (where suburban condos are located), prices climbed 1.6% in Q4 after increasing 2.2% in Q3.

Analysts attributed the slowdown in price growth in the RCR and OCR areas to resistance from buyers from increasingly expensive projects.

Price growth in the CCR region, by contrast, rose on the back of the prevailing strong economy and low interest rates, which once again enticed foreign investors to pick up luxury homes in Singapore.

“In 2010, much of the activity was focused on the mass and mid-market segments,” said Joseph Tan, CBRE’s executive director for residential. “Foreigners stayed away, thinking that the lack of transaction activity in the high-end segment would lead to a fall in prices and allow them to buy the properties for less.”

But since most high-end home owners proved to have “holding power”, the anticipated fall in luxury home prices did not occur and foreign buyers are slowly returning to the luxury market, Mr Tan said.

The number of foreign home buyers rose by 14% in 2010 compared to 2009, said Knight Frank’s head of consultancy & research Png Poh Soon.

“The tightened regulations in Hong Kong and aggressive anti-speculation rules in China caused some investors to shy away from those markets and directed them to Singapore,” Mr Png said. “High net worth foreign buyers would definitely consider the Singapore property market to park their money.”

Analysts also noted that while the latest round of cooling measures introduced by the government on Aug 30 have not dampened transaction volumes, they appear to have at least moderated price growth. A record 15,500 – 16,500 new private homes are estimated to have been sold in 2010, despite demand-side and supply-side measures introduced periodically throughout the year.

CBRE’s Mr Tan said that transaction volumes were still high in 2010 as many potential buyers are still out looking for units.

But the price growth has slowed as these buyers – especially those house-hunting in the mass-market segment – are sticking to a budget.

Looking ahead, growth in private home prices may slow to anywhere between 3% and 10% in 2011, analysts predicted.

But most are more bullish on luxury home prices, which some said could climb by up to 15% this year.

In the mass-market segment, the ample supply of new homes coming on-stream from the beefed-up 2010 Government Land sales programme should help to keep price growth to less than 5%, analysts said.

.

Monday, January 3, 2011

DUNSFOLD RESIDENCES (Review)

.

After a month-long hiatus (slightly longer actually), the wife and I decided to check out Dunsfold Residences yesterday.

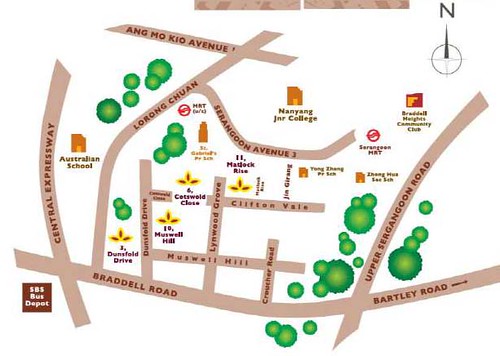

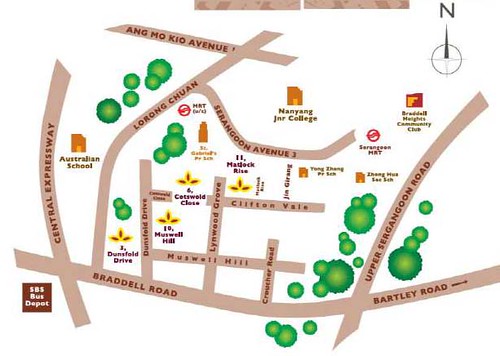

Dunsfold Residences is a cluster bungalow project along Dunsfold Drive (off Bradell Road). It is located within the Bradell Heights landed housing enclave, which according to the wife, is a prime landed estate outside the Core Central Region.

Dunsfold Residences consist of 6 freehold strata bungalows built on a site area of about 11,200sqft. The bungalows come in different sizes of between 5737 to 6329sqft (strata area). It is developed by Dunsfold Residences Pte Ltd, which actually tells us nothing about the developer. Our web search drew a blank too.

Each bungalow has 5 levels (2 Basements, 2 Storey and an Attic) and 5 bedrooms (6, if you count the bomb shelter in basement 2 as well). Each house also gets 2 parking lots and a private pool.

Although the "on paper" TOP date of Dunsfold Residences is 31st Dec 2011, the bungalows looked to be ready for occupation anytime now. We were told that 4 of the 6 bungalows were already sold - only House# 3B and 3C are still available.

As per most cluster housing projects, your "main door" is actually located in the basement carpark, i.e. next to your parking lots.

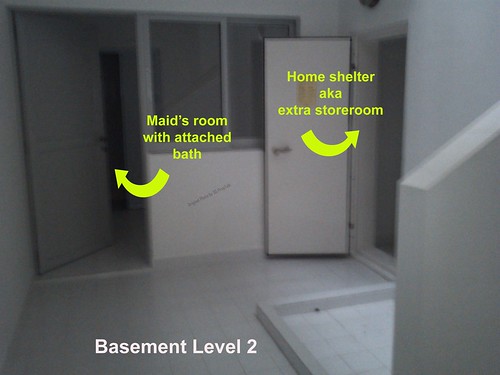

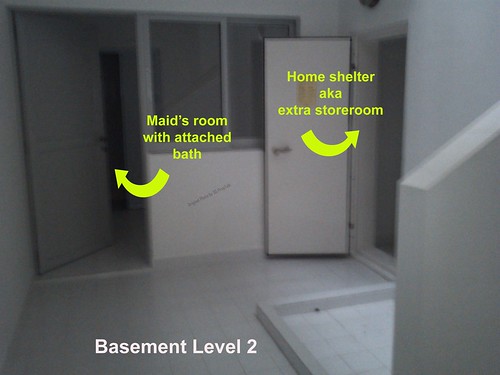

As you enter the "main door", you find a huge bedroom with attached bath - this is ideal as a "granny room", entertainment room, guest room or even a study. You also find two sets of staircases - one leading down to basement 2 (yes, 2 basements!) and the other up to the living/dining room.

Basement 2 is where the maid's room - your domestic helper will be overjoyed as this is one HUUUGE room with attached bath - and bomb shelter are located. There is also ample open space with natural lighting for doing the laundry and ironing... and maybe even play ping-pong! The only issue we have with this area is the air-well - this is uncovered (probably deliberate as it provides better ventilation) , which means it can get rather wet during rainy days.

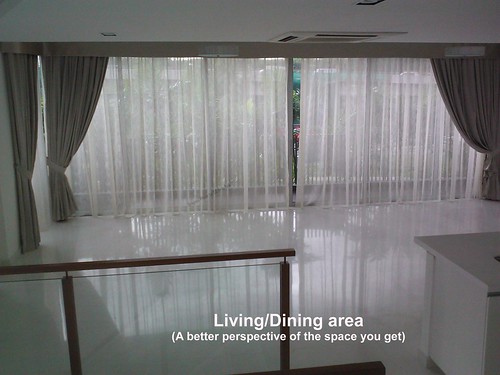

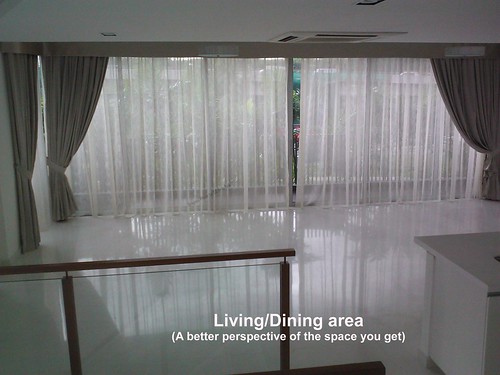

The living/dining/kitchen area is on the ground level. The wife and I like the spacious living/dining room, which is rectangular-shaped with no odd corners (easy on the furniture placement). A guest bathroom is available next to the door that leads you to the pool area.

The kitchen is spacious and functional. However, the cooking hob/hood and kitchen fittings/cabinets that are provided looked rather nondescript, which is somewhat of a disappointment.

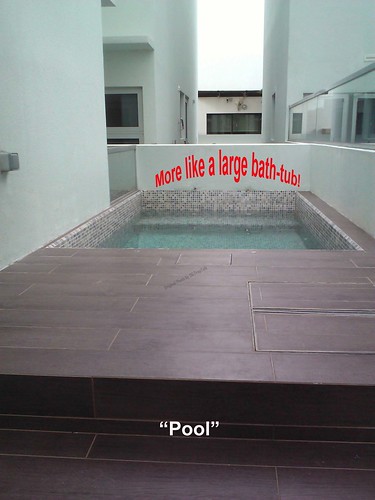

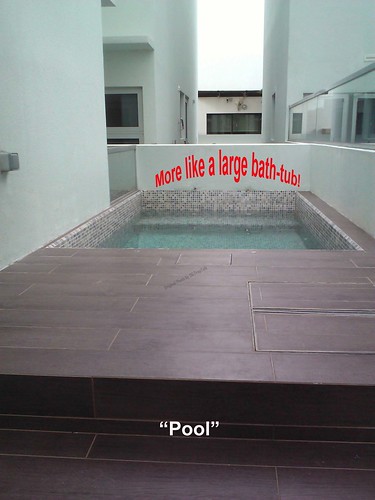

"The "pool" resembled a rectangular bath-tub - not particularly impressive in our opinion.

Two bedrooms are located on the second floor - both very good-sized and regular-shaped. Both are "en-suite" but they share the same bathroom, i.e. the bathroom has 2 separate doors that lead into each of the bedroom.

The master bedroom is located on the top (attic) level. Space will be the last thing you need to worry in here - the real challenge is how to furnish the room adequately so that it does not look bare.

The attached bathroom comes with "His" and "Her" sinks but no bath-tub - this is perfectly fine by us but those of you that enjoy a good soak in the long tub after a hard day will be disappointed. Then again, there is always the "bath tub" (aka pool) outside.

The master bedroom also comes with ample wardrobe space, but the final finishing can certainly be better (okay, we are probably being picky but then again, you are paying good money for this!).

As the master bedroom is located in the attic level of the house, you find a somewhat odd-looking storage space next to the wardrobe. The space is probably good for storing your luggages, golf bags (although it's a looong way to lug them down to the basement everytime you head out to the golf course), and definitely an excellent hiding place when playing hide-and-seek!

The wife and I were told that Dunsfold Residences is within a 10-minutes walk to Lorong Chuan MRT (just don't ask us how to get there), with easy access to CTE/PIE/KPE. The "easy CTE access" bit we can certainly appreciate, as the two remaining unsold houses (3B & 3C) are situated right beside the Lorong Chuan/CTE intersection. So yes, they are a tad noisy if you open the windows - which probably explains why they are still unsold.

But if you don't mind the noise (or do not open the windows of your house much), and have a budget of around $3 million, Dunsfold Residences may be worth a visit. This is especially if you are looking for a big house with spacious interior living.

.

After a month-long hiatus (slightly longer actually), the wife and I decided to check out Dunsfold Residences yesterday.

Dunsfold Residences is a cluster bungalow project along Dunsfold Drive (off Bradell Road). It is located within the Bradell Heights landed housing enclave, which according to the wife, is a prime landed estate outside the Core Central Region.

Dunsfold Residences consist of 6 freehold strata bungalows built on a site area of about 11,200sqft. The bungalows come in different sizes of between 5737 to 6329sqft (strata area). It is developed by Dunsfold Residences Pte Ltd, which actually tells us nothing about the developer. Our web search drew a blank too.

Each bungalow has 5 levels (2 Basements, 2 Storey and an Attic) and 5 bedrooms (6, if you count the bomb shelter in basement 2 as well). Each house also gets 2 parking lots and a private pool.

Although the "on paper" TOP date of Dunsfold Residences is 31st Dec 2011, the bungalows looked to be ready for occupation anytime now. We were told that 4 of the 6 bungalows were already sold - only House# 3B and 3C are still available.

As per most cluster housing projects, your "main door" is actually located in the basement carpark, i.e. next to your parking lots.

As you enter the "main door", you find a huge bedroom with attached bath - this is ideal as a "granny room", entertainment room, guest room or even a study. You also find two sets of staircases - one leading down to basement 2 (yes, 2 basements!) and the other up to the living/dining room.

Basement 2 is where the maid's room - your domestic helper will be overjoyed as this is one HUUUGE room with attached bath - and bomb shelter are located. There is also ample open space with natural lighting for doing the laundry and ironing... and maybe even play ping-pong! The only issue we have with this area is the air-well - this is uncovered (probably deliberate as it provides better ventilation) , which means it can get rather wet during rainy days.

The living/dining/kitchen area is on the ground level. The wife and I like the spacious living/dining room, which is rectangular-shaped with no odd corners (easy on the furniture placement). A guest bathroom is available next to the door that leads you to the pool area.

The kitchen is spacious and functional. However, the cooking hob/hood and kitchen fittings/cabinets that are provided looked rather nondescript, which is somewhat of a disappointment.

"The "pool" resembled a rectangular bath-tub - not particularly impressive in our opinion.

Two bedrooms are located on the second floor - both very good-sized and regular-shaped. Both are "en-suite" but they share the same bathroom, i.e. the bathroom has 2 separate doors that lead into each of the bedroom.

The master bedroom is located on the top (attic) level. Space will be the last thing you need to worry in here - the real challenge is how to furnish the room adequately so that it does not look bare.

The attached bathroom comes with "His" and "Her" sinks but no bath-tub - this is perfectly fine by us but those of you that enjoy a good soak in the long tub after a hard day will be disappointed. Then again, there is always the "bath tub" (aka pool) outside.

The master bedroom also comes with ample wardrobe space, but the final finishing can certainly be better (okay, we are probably being picky but then again, you are paying good money for this!).

As the master bedroom is located in the attic level of the house, you find a somewhat odd-looking storage space next to the wardrobe. The space is probably good for storing your luggages, golf bags (although it's a looong way to lug them down to the basement everytime you head out to the golf course), and definitely an excellent hiding place when playing hide-and-seek!

The wife and I were told that Dunsfold Residences is within a 10-minutes walk to Lorong Chuan MRT (just don't ask us how to get there), with easy access to CTE/PIE/KPE. The "easy CTE access" bit we can certainly appreciate, as the two remaining unsold houses (3B & 3C) are situated right beside the Lorong Chuan/CTE intersection. So yes, they are a tad noisy if you open the windows - which probably explains why they are still unsold.

But if you don't mind the noise (or do not open the windows of your house much), and have a budget of around $3 million, Dunsfold Residences may be worth a visit. This is especially if you are looking for a big house with spacious interior living.

.

Saturday, January 1, 2011

And the grand total is...

The wife and I would like to thank those of you who had supported the donation drive for our adopted charity for 2010 - Rainbow Centre.

The total amount of Ad earnings that we have collected (but not paid - Nuffnang, are you seeing this?) came up to... S$53.32. Well, we reckon it's not so much the money but the thought that counts... :-)

As promised, we will round the amount up to a hundred bucks and donate the money to Rainbow Centre.

We will probably adopt another charity for 2011, so please help us to help them by clicking on the ads that appears on our blog.

.